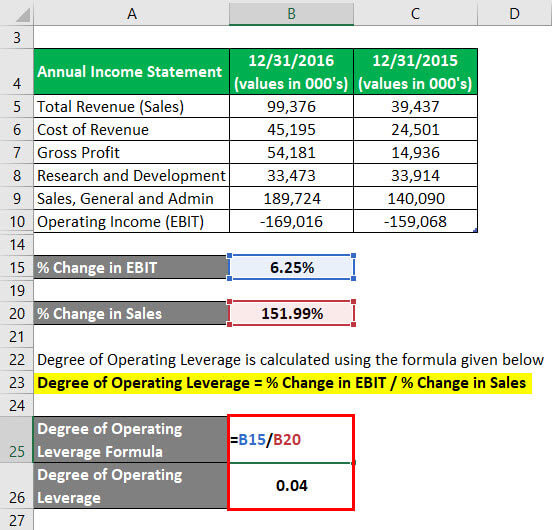

Moreover, the negative operating leverage implies that the operating income decreases as the revenue increases, which is inconsistent with the traditional definition of operating leverage. traditional methods of allocating manufacturing overhead is defined as percentage change in operating income that occurs in response to a percentage change in sales. It does this by measuring how sensitive a company is to operating income sales changes. Higher measures of leverage mean that a company’s operating income is more sensitive to sales changes.

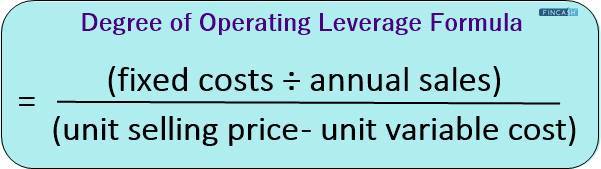

Derivation of DOL Formula

Companies with a high degree of operating leverage (DOL) have a greater proportion of fixed costs that remain relatively unchanged under different production volumes. The operating leverage formula is used to calculate a company’s break-even point and help set appropriate selling prices to cover all costs and generate a profit. This can reveal how well a company uses its fixed-cost items, such as its warehouse, machinery, and equipment, to generate profits. The more profit a company can squeeze out of the same amount of fixed assets, the higher its operating leverage. The formula can reveal how well a company uses its fixed-cost items, such as its warehouse, machinery, and equipment, to generate profits. This ratio summarizes the effects of combining financial and operating leverage, and what effect this combination, or variations of this combination, has on the corporation’s earnings.

Ask Any Financial Question

For each product sale that Walmart rings in, the company has to pay for the supply of that product. As a result, Walmart’s cost of goods sold (COGS) continues to rise as sales revenues rise. If a company has high operating leverage, then it means that a large proportion of its overall cost structure is due to fixed costs. Such a company will enjoy huge changes in profits with a relatively smaller increase in sales.

Company

In addition, in this scenario, the selling price per unit is set to $50.00, and the cost per unit is $20.00, which comes out to a contribution margin of $300mm in the base case (and 60% margin). Despite the significant drop-off in the number of units sold (10mm to 5mm) and the coinciding decrease in revenue, the company likely had few levers to pull to limit the damage to its margins. However, the downside case is where we can see the negative side of high DOL, as the operating margin fell from 50% to 10% due to the decrease in units sold. If a company has high operating leverage, each additional dollar of revenue can potentially be brought in at higher profits after the break-even point has been exceeded. It is important to understand the concept of the DOL formula because it helps a company appreciate the effects of operating leverage on the probable earnings of the company.

What are the limitations of using DOL?

The DOL measures the how sensitive operating income (or EBIT) is to a change in sales revenue. In the table above, sales revenue increased by 10% ($62,500 to $68,750). However, it resulted in a 25% increase in operating income ($10,000 to $12,500). A 10% increase in sales will result in a 30% increase in operating income.

- When sales increase, a company with high operating leverage can see significant boosts in operating income due to the fixed nature of its costs.

- He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

- Companies with high fixed costs relative to variable costs will exhibit high operating leverage, meaning their earnings are more volatile with changes in sales.

- Higher measures of leverage mean that a company’s operating income is more sensitive to sales changes.

DOL helps investors assess the potential risks and rewards of a company’s cost structure, giving insights into how changes in sales might impact profitability. Consider a company with fixed costs of $500,000, variable costs of $2 per unit, and selling price of $10 per unit. The degree of operating leverage calculator is a tool that calculates a multiple that rates how much income can change as a consequence of a change in sales. In this article, we will learn more about what operating leverage is, its formula, and how to calculate the degree of operating leverage. Furthermore, from an investor’s point of view, we will discuss operating leverage vs. financial leverage and use a real example to analyze what the degree of operating leverage tells us.

It is important to compare operating leverage between companies in the same industry, as some industries have higher fixed costs than others. The higher the degree of operating leverage, the greater the potential danger from forecasting risk, in which a relatively small error in forecasting sales can be magnified into large errors in cash flow projections. A high DOL can be good if a company is expecting an increase in sales, as it will lead to a corresponding operating income increase.

Still, it gives many useful insights about a company’s operating leverage and ability to handle fluctuations and major economic events. Such businesses tend to have higher volatility of share prices and operating incomes in any economic catastrophe or change in demand pattern. If you try different combinations of EBIT values and sales on our smart degree of operating leverage calculator, you will find out that several messages are displayed. Even a rough idea of a firm’s operating leverage can tell you a lot about a company’s prospects. In this article, we’ll give you a detailed guide to understanding operating leverage. If all goes as planned, the initial investment will be earned back eventually, and what remains is a high-margin company with recurring revenue.

There are fewer variable costs in a cost structure with a high degree of operating leverage, and variable costs always cut into added productivity—though they also reduce losses from lack of sales. Higher fixed costs lead to higher degrees of operating leverage; a higher degree of operating leverage creates added sensitivity to changes in revenue. More sensitive operating leverage is considered riskier since it implies that current profit margins are less secure moving into the future. Return on equity, free cash flow (FCF) and price-to-earnings ratios are a few of the common methods used for gauging a company’s well-being and risk level for investors. One measure that doesn’t get enough attention, though, is operating leverage, which captures the relationship between a company’s fixed and variable costs.

On the contrary, companies having low operating leverage may find it effortless to earn a profit when trading with lower sales. Similarly, percentage change in sales equals change in sales divided by initial sales. Degree of operating leverage can never be negative because it is a ratio of two positive numbers (sales and operating income). Variable costs vary with production levels, such as raw materials and labor. Fixed costs remain constant regardless of production levels, such as rent and insurance. There are various measures of operating leverage,[1]which can be interpreted analogously to financial leverage.

Variable costs decreased from $20mm to $13mm, in-line with the decline in revenue, yet the impact it has on the operating margin is minimal relative to the largest fixed cost outflow (the $100mm). On the other hand, if the case toggle is flipped to the “Downside” selection, revenue declines by 10% each year, and we can see just how impactful the fixed cost structure can be on a company’s margins. The direct cost of manufacturing one unit of that product was $2.50, which we’ll multiply by the number of units sold, as we did for revenue.