Positive cash flow that occurs during a period, such as revenue or accounts receivable means an increase in liquid assets. On the other hand, negative cash flow such as the payment for expenses, rent, and taxes indicate a decrease in liquid assets. Oftentimes, cash flow is conveyed as a net of the sum total of both positive and negative cash flows during a period, as is done for the calculator. The study of cash flow provides a general indication of solvency; generally, having adequate cash reserves is a positive sign of financial health for an individual or organization. Payback period is the time in which the initial outlay of an investment is expected to be recovered through the cash inflows generated by the investment.

How do I calculate the payback period in Excel?

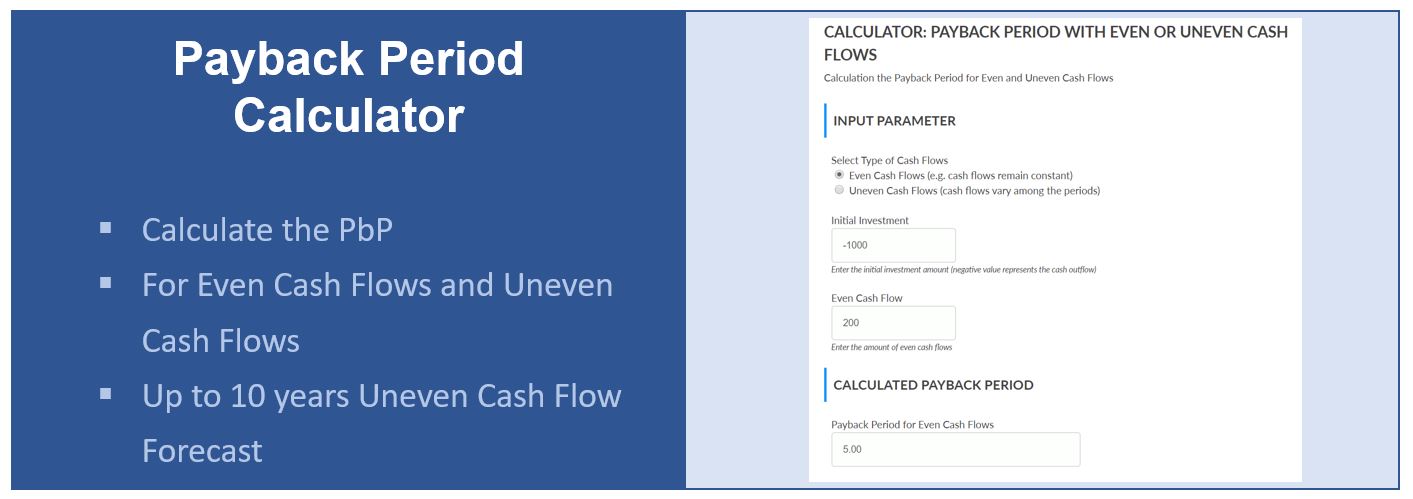

It can be calculated by dividing the initial investment cost by the annual net cash flow generated by that investment. The simple payback period formula is calculated by dividing the cost of the project or investment by its annual cash inflows. Payback period is a financial or capital budgeting method that calculates the number of days required for an investment to produce cash flows equal to the original investment cost. In other words, it’s the amount of time it takes an investment to earn enough money to pay for itself or breakeven. This time-based measurement is particularly important to management for analyzing risk.

- Unlike net present value , profitability index and internal rate of return method, payback method does not take into account the time value of money.

- The main reason for this is it doesn’t take into consideration the time value of money.

- One way corporate financial analysts do this is with the payback period.

- Using the subtraction method, one starts by subtracting individual annual cash flows from the initial investment amount, and then does the division.

How to Calculate Percentage Change on Excel

It is one of the simplest capital budgeting techniques and, for this reason, is commonly used to evaluate and compare capital projects. Getting repaid or recovering the initial cost of a project or investment should be achieved as quickly as it allows. However, not all projects and investments have the same time horizon, so the shortest possible payback period needs to be nested within the larger context of that time horizon.

Payback Period vs. Discounted Payback Period

This still has the limitation of not considering cash flows after the discounted payback period. If opening the new stores amounts to an initial investment of $400,000 and the expected cash flows from the stores would be $200,000 each year, then the period would be 2 years. A higher payback period means it will take longer for a company to cover its initial investment. All else being equal, it’s usually better for a company to have a lower payback period as this typically represents a less risky investment. The quicker a company can recoup its initial investment, the less exposure the company has to a potential loss on the endeavor.

How to Calculate When Your Solar Panels Will Start Saving You Money

When deciding on any project to embark on, a company or investor wants to know when their investment will pay off, meaning when the cash flows generated from the project will cover the cost of the project. A large purchase like a machine would be a capital expense, the cost of which is allocated for in a company’s accounting over many years. No such adjustment for this is made in the payback period calculation, instead it assumes this is a one-time cost. Due to its ease of use, payback period is a common method used to express return on investments, though it is important to note it does not account for the time value of money. As a result, payback period is best used in conjunction with other metrics.

Assessing Risk

He’ll have no sooner finished paying off the machine, then he will have to buy another one. Perhaps in his case the profit might be worth it, depending on what else is going on in his business. However, it’s likely he would search out another machine to buy, one with a longer life, or shelf the idea altogether. Thus, the above are some benefits and limitations of the concept of payback period in excel. It is important for players in the financial market to understand them clearly so that they can be used appropriately as and when required and get the benefit of it to the maximum possible extent. • To calculate the payback period you divide the Initial Investment by Annual Cash Flow.

You can use it when analyzing different possibilities to invest your money and combine it with other tools, such as the net present value (NPV calculator) or internal rate of return metrics (IRR calculator). For example, a project cost is $ 20,000, and annual cash flows are uniform at $4,000 per annum, and the life of the asset acquire is 5 years, then the payback period reciprocal will be as follows. Using the subtraction method, one starts by subtracting individual annual cash flows from the initial investment amount, and then does the division. The payback period can help investors decide between different investments that may have a lot of similarities, as they’ll often want to choose the one that will pay back in the shortest amount of time.

The value obtained using the discounted payback period calculator will be closer to reality, although undoubtedly more pessimistic. Both the above are financial metrics used for analysis and evaluation of projects and investment opportunities. Management uses the payback period calculation to decide what investments or projects to pursue. The payback period equation also doesn’t take into account the effects an investment might have on the rest of the company’s operations. For instance, new equipment might require a significant amount of expensive power, or might not be able to run as often as it would need to in order to reach the payback goal.

Every year, your money will depreciate by a certain percentage, called the discount rate. Jim estimates that the new buffing wheel will save payback period formula 10 labor hours a week. Thus, at $250 a week, the buffer will have generated enough income (cash savings) to pay for itself in 40 weeks.

In reality, projects are unlikely to have constant annual projected returns. In this case, setting up a table in Excel will help evaluate and estimate the payback period. The table is structured the same as the previous example, however, the cash flows are discounted to account for the time value of money.