In DCF analysis, the weighted average cost of capital (WACC) is the discount rate used to compute the present value of future cash flows. WACC is the calculation of a firm’s cost of capital, where each category of capital, such as equity or bonds, is proportionately weighted. For more detailed cash flow analysis, WACC is usually used in place of discount rate because it is a more accurate measurement of the financial opportunity cost of investments. WACC can be used in place of discount rate for either of the calculations.

What Are the Advantages of Calculating the Payback Period?

For example, you could use monthly, semi annual, or even two-year cash inflow periods. The cash inflows should be consistent with the length of the investment. You can use the payback period in your own life when making large purchase decisions and consider their opportunity cost. Understanding the way that companies calculate their payback period is also helpful to determine their financial viability and whether it makes sense for you to invest in them as part of your portfolio. Calculating payback periods is especially important for startup companies with limited capital that want to be sure they can recoup their money without going out of business.

- You can use the payback period in your own life when making large purchase decisions and consider their opportunity cost.

- Obviously, the longer it takes an investment to recoup its original cost, the more risky the investment.

- The situation gets a bit more complicated if you’d like to consider the time value of money formula (see time value of money calculator).

- Getting repaid or recovering the initial cost of a project or investment should be achieved as quickly as it allows.

Payback Period (Payback Method)

As a general rule of thumb, the shorter the payback period, the more attractive the investment, and the better off the company would be. Average cash flows represent the money going into and out of the investment. Inflows are any items that go into the investment, such as deposits, dividends, or earnings. Cash outflows include any fees or charges that are subtracted from the balance. There are a lot of different ways to pay for solar panels, and they all affect the solar payback period. It’s a key number — usually a matter of years — that tells you how long you’ll wait to see a real return on your investment.

Payback Period Vs Return On Investment(ROI)

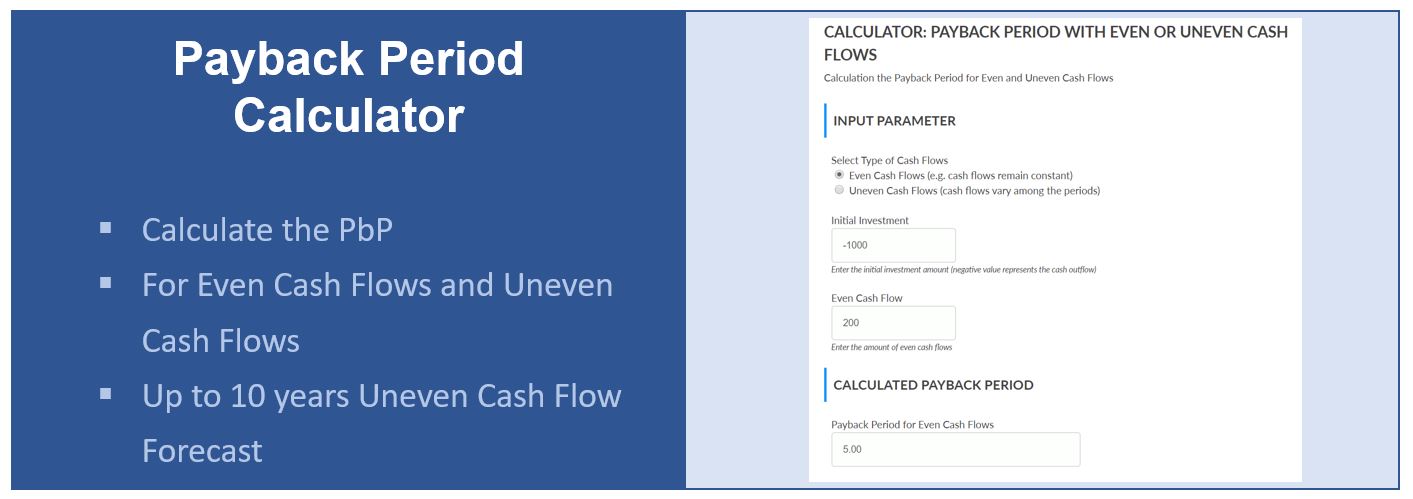

Although calculating the payback period is useful in financial and capital budgeting, this metric has applications in other industries. It can be used by homeowners and businesses to calculate the return on energy-efficient technologies such as solar panels and insulation, including maintenance and upgrades. This payback period calculator is a tool that lets you estimate the number of years required to break even from an initial investment.

Or maybe there’s something else going on at the plant that prevents it from functioning properly. Every investor, be it individual or corporate will want to assess how long it will take for them to get back the initial capital. This is because it is always worthwhile to invest in an opportunity in which there is enough net revenue to cover the initial cost.

Payback method

In the first row, create headers for the different pieces of information you are going to use in your calculation. These headers should include Initial Investment, Cash Inflow, Cumulative Cash Flow, and Payback Period. Let us understand the concept of how to calculate payback period with the help of some suitable examples. With active investing, payback period formula you can hand select each individual stock or ETF you wish to add to your portfolio. Using automated investing, you can choose from groups of pre-selected stocks. There are additional tools in the app to set personal financial goals and add all your banking and investment accounts so you can see all of your information in one place.

For example, three projects can have the same payback period with varying break-even points due to the varying flows of cash each project generates. The discounted payback period extends the concept of the payback period by considering the time value of money. Here, future cash inflows are discounted using a particular rate, reflecting their present value.

As a rule of thumb, the shorter the payback period, the better for an investment. Any investments with longer payback periods are generally not as enticing. The payback period calculation doesn’t account for the time value of money or consider cash inflows beyond the payback period, which are still relevant for overall profitability. Therefore, businesses need to use other financial metrics in conjunction with payback period to make informed investment decisions. Longer payback periods are not only more risky than shorter ones, they are also more uncertain. The longer it takes for an investment to earn cash inflows, the more likely it is that the investment will not breakeven or make a profit.

One great online investing tool is SoFi Invest® online brokerage platform. The investing platform lets you research and track your favorite stocks and ETFs. You can easily buy and sell with just a few clicks on your phone, and view your portfolio on one simple dashboard. The easiest method to audit and understand is to have all the data in one table and then break out the calculations line by line.

In summary, the payback period and its variant, the discounted payback period, serve as useful initial screenings for investment projects, focusing on liquidity risk. Despite the simplicity and ease of use, considering other metrics like NPV and IRR is imperative to encompassing a project’s true financial impact and ensuring a balanced investment decision-making process. People and corporations mainly invest their money to get paid back, which is why the payback period is so important.