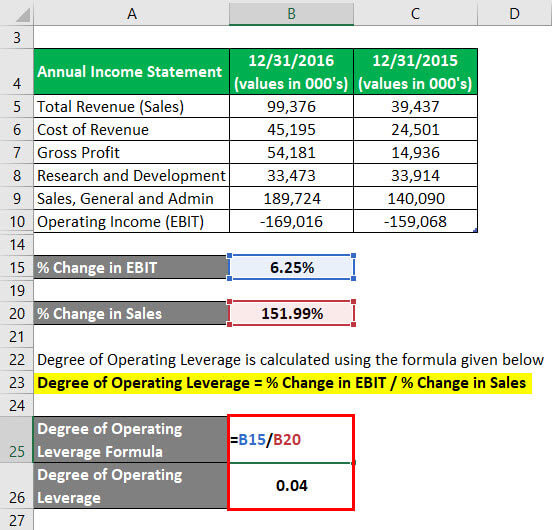

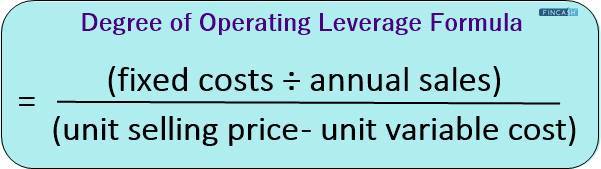

This includes labor to assemble products and the cost of raw materials used to make products. Some companies earn less profit on each sale but can have a lower sales volume and still generate enough to cover fixed costs. Operating leverage is a cost-accounting formula (a financial ratio) that measures the degree to which a firm or project can increase operating income by increasing revenue.

Derivation of DOL Formula

DOL is based on historical data and may not accurately predict future performance. Additionally, it does not consider the impact of external factors like market conditions and economic changes. If you have the percentual change (period to period) of EBIT, put it here. We will discuss each of those situations because it is crucial to understand how to interpret it as much as it is to know the operating leverage factor figure. These two costs are conditional on past demand volume patterns (and future expectations).

Which of these is most important for your financial advisor to have?

The financial leverage ratio divides the % change in sales by the % change in earnings per share (EPS). You then take DOL and multiply it by DFL (degree of financial leverage). Financial leverage is a measure of how much a company has borrowed in relation to its equity. In other words, operating leverage is the measure of fixed costs and their impact margin of safety on the EBIT of the firm. Managers need to monitor DOL to adjust the firm’s pricing structure towards higher sales volumes as a small decrease in sales can lead to a dramatic decrease in profits. For example, in a company with high DOL, a 10% increase in sales could lead to a more than 10% increase in EBIT, magnifying the impact on profitability.

Would you prefer to work with a financial professional remotely or in-person?

When sales increase, a company with high operating leverage can see significant boosts in operating income due to the fixed nature of its costs. Conversely, if sales decline, the company still needs to cover substantial fixed costs, which can significantly hurt profitability. If fixed costs are higher in proportion to variable costs, a company will generate a high operating leverage ratio and the firm will generate a larger profit from each incremental sale. A larger proportion of variable costs, on the other hand, will generate a low operating leverage ratio and the firm will generate a smaller profit from each incremental sale. In other words, high fixed costs means a higher leverage ratio that turn into higher profits as sales increase.

- A measure of this leverage effect is referred to as the degree of operating leverage (DOL), which shows the extent to which operating profits change as sales volume changes.

- Degree of operating leverage, or DOL, is a ratio designed to measure a company’s sensitivity of EBIT to changes in revenue.

- If a firm generates a high gross margin, it also generates a high DOL ratio and can make more money from incremental revenues.

The Operating Leverage measures the proportion of a company’s cost structure that consists of fixed costs rather than variable costs. To calculate the degree of operating leverage, you will need to know the company’s sales, variable costs, and operating income. The DOL of a firm gives an instant look into the cost structure of the firm. The degree of operating leverage directly impacts the firm’s profitability. We already discussed that the higher operating leverage implies higher fixed costs. Under all three cases, the contribution margin remains constant at 90% because the variable costs increase (and decrease) based on the change in the units sold.

In finance, companies assess their business risk by capturing a variety of factors that may result in lower-than-anticipated profits or losses. One of the most important factors that affect a company’s business risk is operating leverage; it occurs when a company must incur fixed costs during the production of its goods and services. A higher proportion of fixed costs in the production process means that the operating leverage is higher and the company has more business risk. At the same time, a company’s prices, product mix and cost of inventory and raw materials are all subject to change.

Managers use operating leverage to calculate a firm’s breakeven point and estimate the effectiveness of pricing structure. An effective pricing structure can lead to higher economic gains because the firm can essentially control demand by offering a better product at a lower price. If the firm generates adequate sales volumes, fixed costs are covered, thereby leading to a profit. However, to cover for variable costs, a firm needs to increase its sales. A high DOL indicates that a company has a larger proportion of fixed costs compared to variable costs. This suggests that the company’s earnings before interest and taxes (EBIT) are highly sensitive to changes in sales.

However, a high DOL can be bad if a company is expecting a decrease in sales, as it will lead to a corresponding decrease in operating income. A high DOL means that a company’s operating income is more sensitive to sales changes. Degree of combined leverage measures a company’s sensitivity of net income to sales changes. The higher the DOL, the greater the operating leverage and the more risk to the company. This is because small changes in sales can have a large impact on operating income. Degree of operating leverage, or DOL, is a ratio designed to measure a company’s sensitivity of EBIT to changes in revenue.

This information shows that at the present level of operating sales (200 units), the change from this level has a DOL of 6 times. High operating leverage can be risky for a company in several ways, including reduced flexibility, magnified effects of revenue changes, financial risk, and strategic risk. Percentage change in operating income equals change in operating income divided by initial operating income. A company with high financial leverage is riskier because it can struggle to make interest payments if sales fall. We’ll go over exactly what it is, the formula used to calculate it, and how it compares to the combined leverage.

The shared characteristic of low DOL industries is that spending is tied to demand, and there are more potential cost-cutting opportunities. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

If the company’s sales increase by 10%, from $1,000 to $1,100, then its operating income will increase by 10%, from $100 to $110. However, if sales fall by 10%, from $1,000 to $900, then operating income will also fall by 10%, from $100 to $90. And the irony of the situation is that there is a tiny margin to adjust yourself by cutting fixed costs in demand fluctuations and economic downturns. For a low degree of operating leverage, the short-term revenue fluctuation doesn’t hurt the company’s profitability to a larger extent. Understanding the degree of operating leverage and its impact on the company’s financial health. The cost structure directly impacts all the other measures, including profitability, response to fluctuations, and future growth.